The Harrison Assessments Benchmarking Process:

• Identifies key success factors that contribute to job success

• Formulates critical job success factors and a comprehensive set of derailers

• Provides information to improve job performance and determine what and where improvements need to be made

• Identifies traits that differentiate high performers from moderate and low performers.

The objective of Performance Benchmarking is to:

• Identify traits related to success for a specific job.

• Identify how the traits are related to success.

Outcome: A Job Success Formula that is customized to the job requirement that can be used to consistently identify high performers.

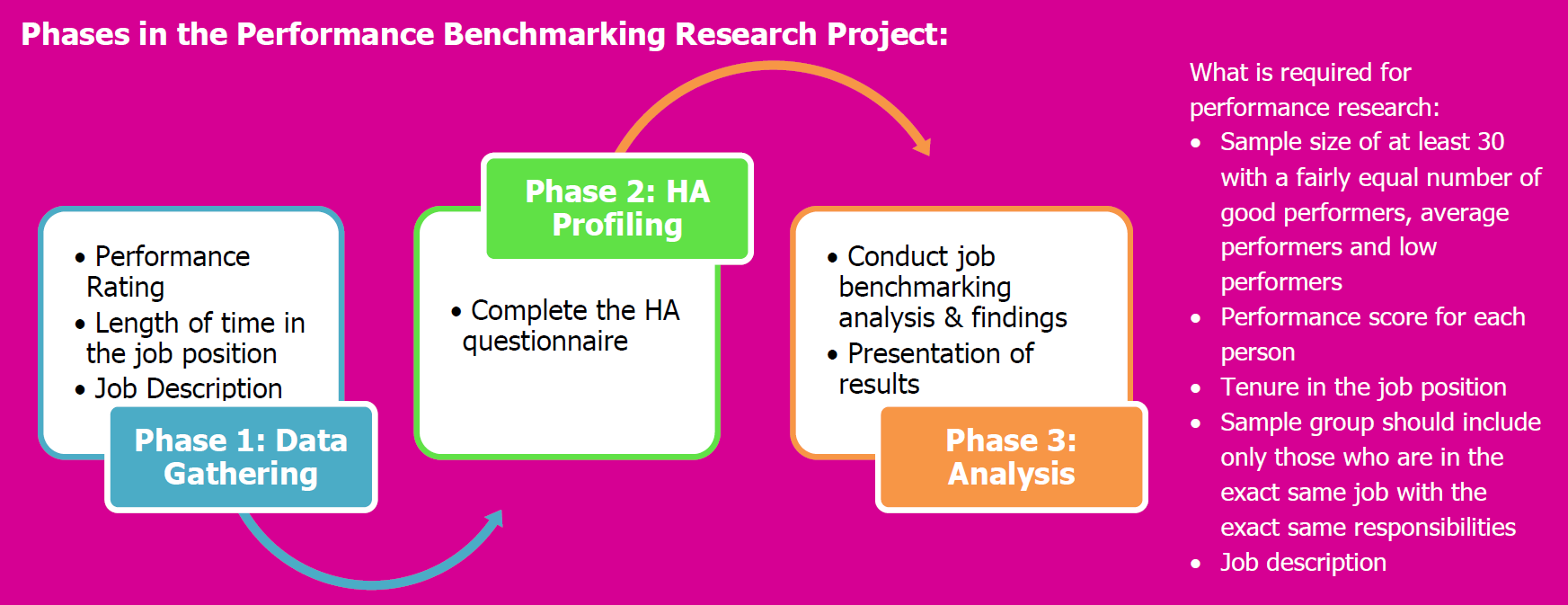

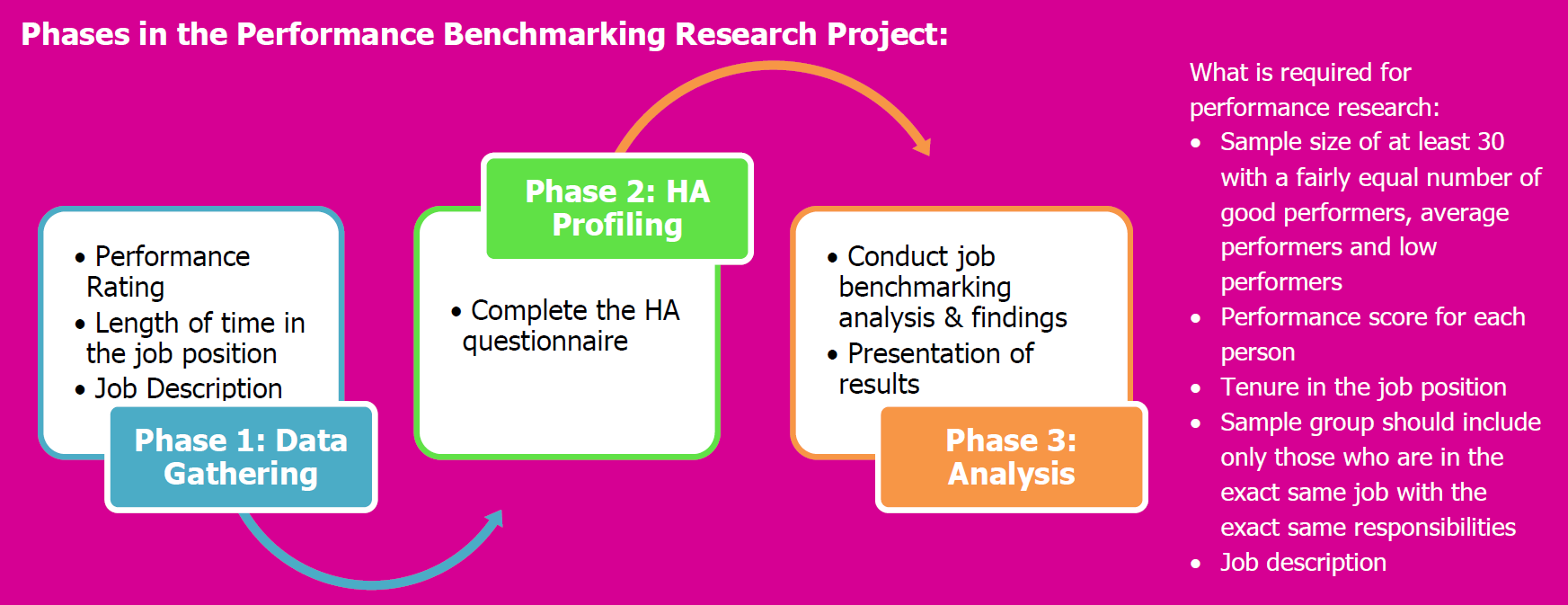

Phases of Performance Benchmarking

Phase 1: Data Gathering & Review

1. Performance Criteria – gather from SMEs at focus group meeting

2. Length of time in job – I incumbents at various performance levels selected for inclusion in the study; Agiledge staff to collect this information and enter on a spreadsheet.

3. Performance Ratings – depending on the final set of KPIs, this data will be collected by Agiledge for each incumbent selected for participation in the study and entered on the spreadsheet with length of time in job above.

4. Job Description – current job description collected from Agiledge (if this needs updating or more work, consultant can work with Agiledge on this).

5. HA reviews data -- all of the above is submitted to the consultants who will organize it, input to the Harrison system and submit to Dr. Dan Harrison to run the analytics.

More about Performance Criteria and Performance Ratings

Performance Criteria – This initial step is the most critical. Since this research method involves the correlation of performance ratings/data with test scores (assessment results), the “wild card” factor in this formula is performance since the assessment results speak for themselves. That is, what makes for top performance in this role? Answering this question determines the ultimate success of the project and the utility of the resulting Job Success Formula.

How to measure job performance?

Most organizations continue to grapple with this question year-after-year and do not have comprehensive, objective and consistent performance evaluation systems in place. Often, management takes the attitude of “I know good performance when I see it,” and gives regional and HQ leaders the leeway to make subjective judgments that are usually based on some objective criteria (i.e. sales targets, earnings, other “hard” data related to profitability) plus other quite subjective criteria (i.e. employee and customer complaints, legal or ethical calls or challenges, reputation, likeability, etc.). The problem with this general approach for the purposes of this study is that it lacks the rigor needed for statistical correlation analysis.

Defining Key Performance Indicators (leading to Performance Ratings)

The key to determining performance criteria is first to acknowledge that performance is likely based on multiple factors, such as financial performance + some other factors related to employee development + perhaps work quality + customer service metrics + others (?). That is, we need to break down performance into its component parts for this particular role across the organization.

To do this well, we propose using Subject-Matter Experts (SMEs) to brainstorm, collaborate and help us define the various elements of good performance; that is, Key Performance Indicators (KPIs) of success. This discussion is led by the facilitators and is a free-flow of ideas within a focus group format on-site and is usually accomplished within a 3-4 hour session.

In advance of the focus group session, selected SME’s should be advised to think carefully about how they, personally, measure performance currently, what might be a more ideal way to evaluate performance, and bring any sales and other financial metrics with them to the session to help with the discussion. The session will result in some consensus from the SME’s about KPI’s that consultants will take-away and fine-tune after the session and later present to the executive team as the performance data that will be used to collect performance ratings from the field for the group of incumbents included in the study.

The KPI formula is likely to be a weighted composite something like the following:

• Sales (define) = 60% of overall rating

• Employee development (define) = 30% of overall rating

• Quality / customer satisfaction (define) = 10% of overall rating

Total = 100%

The resulting KPIs will be used inserted into a table such as the following for collection of performance ratings:

Rating Description KPI formula (insert formula at the various levels)

95% Excellent (e.g. sales at 100% of target or above + X + Y)

85% Very good (e.g. sales at 90% of target + X + Y)

75% High average Etc.

70% Low average “ "

65% Poor “ "

*Harrison Assessments needs roughly equal groups of incumbents in each rating group above to run the study.

Phase 2: HA Profiling and Input: Steps from Chart above summarized

1. Complete the HA questionnaire – Links are sent out by either Agiledge or consultants with instructions on completing the questionnaire and completion date (typically 7 -10 days).

2. Enter the Data into the HATS System – Consultants work with Dr. Harrison on data collection leading to data analysis.

More about Step 2

This step is fairly routine. The communication to the participating incumbents is important to plan and phrase carefully. Often a Greatest Strenghts report is given in appreciateion for their participation and for their own professional development. In some cases, full development report debriefs- but this is a time and economic resource issue. Reports that could be used for this if desired are those without numerical values, such as reports: How to Manage, Develop and Retain, Your Greatest Strengths, Summary and Keywords, and/or Career Development Report. Running reports in this phase incurs additional cost, so this decision needs to be worked out with the consultants prior to sending out links. The other activities in Step 2 are follow-up on incomplete or missing questionnaires and dealing with low consistency scores. These activities are generally shared between the company (Agiledge) and consultants.

Phase 3: Analysis and Presentation: Steps from Chart summarized

1. Conduct Job Benchmarking Analysis and Findings

2. Presentation of Results

After meeting with the executive team and sharing the results of the study, the Job Success Formula will be ready to implement company-wide.